.jpg&h=570&w=855&q=100&v=20250320&c=1)

Source: YouGov Profiles

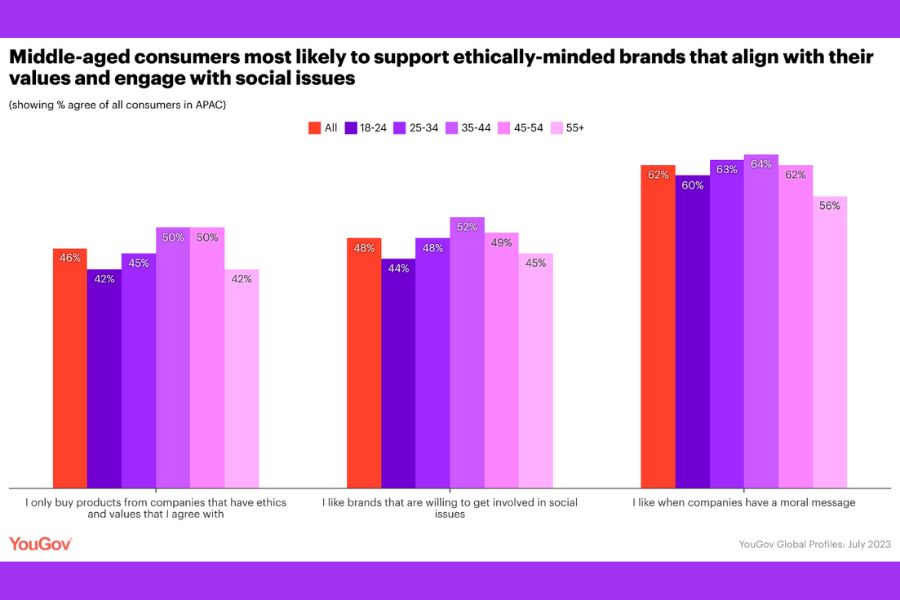

Key findings:

- Almost half of all APAC consumers are drawn to socially conscious brands that display values aligned with their own (46%) and get involved with issues of broader societal interest (48%).

- Consumers aged 35-54 years are most likely to consider a brand’s values when making purchase decisions (50%), while most consumers aged 35-44 years appreciate brands that engage with social issues (52%).

- Brands with a moral message are more likely to appeal to three in five (62%) APAC consumers.

- Regionally, more than half of Indonesian consumers (54%) and over two in five Thai consumers (45%) consider whether a brand upholds values that align with their outlook before purchasing—the highest across key markets in APAC. They are also most likely to appreciate brands that engage with social issues (59% and 47%).

- Meanwhile, brands with a moral message enjoy the broadest appeal in Indonesia (80%) and Hong Kong (60%), although just under a third of consumers like brands that get involved with social issues.

Methodology: YouGov Profiles is based on continuously collected data and rolling surveys rather than from a single limited questionnaire. Profiles data for Australia is nationally representative of all adults (18 years or older), weighted by age, gender, and region, and reflect the latest Australian Bureau of Statistics (ABS) population estimates.

Profiles data for Hong Kong is representative of the adult online population (18 years or older), weighted by age and gender, and reflect the latest Hong Kong Census and Statistics Department (C&SD) population estimates. Profile data for Indonesia represents the adult online population (18 years or older), weighted by gender, age, socioeconomic class, and city tier, and reflects the latest Indonesian Bureau of Statistics (BPS) population estimates.

Profiles data for Singapore is nationally representative of all adults (18 years or older), weighted by age, gender, and ethnicity, and reflect the latest Singapore Department of Statistics (DOS) estimates.

Profiles data for Thailand is representative of the adult online population (18 years or older), weighted by gender, age, region and monthly household income, and reflects the latest National Statistical Office of Thailand (NSO) population estimates.

Other findings:

- When it comes to choosing green and humane product options, the latest data reveals that about half of all APAC consumers try to buy from brands that are socially and environmentally responsible (48%) and that engage in fair trade processes (53%).

- Around half are willing to pay more for eco-friendly products (51%).

- Buying from socially and environmentally responsible companies is a priority for most Thai (62%) and Indonesian (55%) consumers but for roughly only a third in Singapore (33%) and Hong Kong (34%).

- Looking out for fair trade products is something close to two-thirds of consumers in Indonesia (64%) try to do, but only two in five consumers in other key APAC markets say the same.

- Indonesian consumers are also most open to spending more for eco-friendly products (72%), ahead of Thai (51%) and Australian (50%) consumers, while less than half of Singaporean (41%) and Hong Kong (38%) consumers would.

- Besides social and environmental considerations, around half of all APAC consumers are concerned with extensive online and multinational enterprises driving out small businesses in their community (49%).

- Over half of all APAC consumers prefer buying from local community shops over foreign ones (51%) and try to support local businesses (56%). Older consumers are more likely to prefer to buy from and support local businesses.

- Regionally, consumers in Indonesia are most likely to conscientiously support local businesses (82%) and prefer shopping locally (68%), followed by Australia.

- On the other hand, Singapore is the only market where less than half of consumers say they make an effort to support local businesses (49%) and prefer shopping close-by (40%).

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

+(1).jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.png&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)